Global Market Reaction to Iran Missile Attack in Four Charts

Safe-haven assets, U.S. equity futures and Asian stocks swung wildly Wednesday as tensions in the Middle East escalated, rattling global financial market.

Iran’s attack on American military bases in Iraq, a response to the assassination of General Qassem Soleimani by American forces last week, injected new volatility into global assets that enjoyed a blockbuster 2019. S&P 500 futures dropped as much as 1.7% as fears of a protracted conflict increased, before paring the decline as Tehran said it wasn’t seeking a war, and President Donald Trump declared “all is well.”

Here are some charts showing the moves:

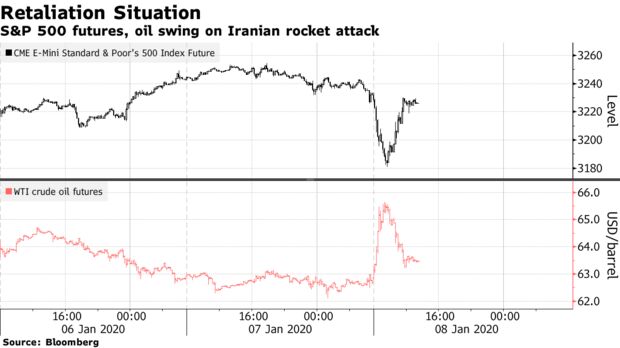

Oil and U.S. Stocks

West Texas Intermediate crude futures initially jumped by as much as 4.4% while CME E-mini S&P 500 Index futures tumbled by more than 1%. The moves eased later as there were no signs of an immediate military response from Washington.

Treasuries, Dollar/Yen

Ten-year Treasury yields dropped more than 11 basis points to 1.70% before paring much of the loss, and the dollar swung against yen. Further conflict in the Middle East could send 10-year Treasury yields to as low as 1.6% in the short-to-medium term, said Kyle Rodda, analyst at IG Markets in Melbourne.

Gold

The precious metal rose through $1,600 an ounce to the highest level since 2013 before retreating from its highs.

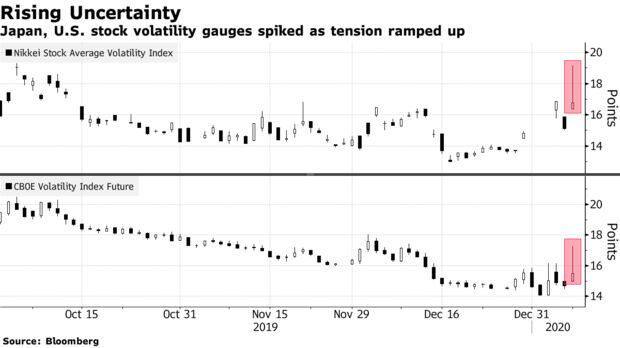

Volatility

The Nikkei Stock Average Volatility Index soared as much as 4 points and CBOE Volatility Index January futures advanced almost 3 points, as options traders scrambled to reprice future expectations for swings in stock markets. The moves retraced as investors stepped in to buy the dip in risk assets.

Source: Bloomberg